By Megan Cole

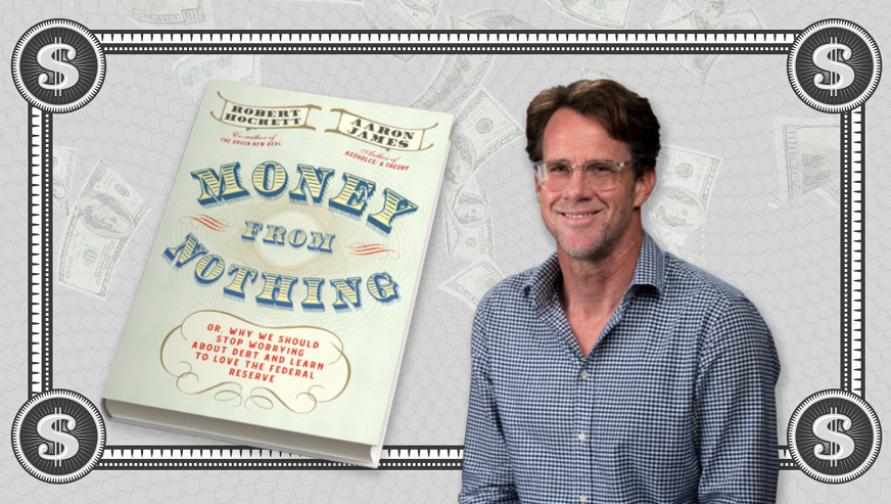

What if money could appear in our bank accounts out of thin air — without increased taxes, longer work hours, austerity measures or any other strings attached? Not only is this utopian premise entirely possible, it might be the norm in the very near future, argues UCI philosophy professor Aaron James in his new book, Money from Nothing: Or, Why We Should Stop Worrying About Debt and Learn to Love the Federal Reserve (Melville House, 2020).

Written for the public, Money from Nothing complements an increasingly popular school of economic thought called modern monetary theory (MMT) but goes further in explaining how we can democratize the banking system and restore the social contract. James and his co-author, financial law expert Robert Hockett (Cornell University), contend that the U.S. Federal Reserve Bank is fully capable of creating money “out of thin air,” and indeed, already does to support many sectors of the economy. Since money can be created “from nothing,” the government doesn’t need tax revenue to pay for expenditures; it can simply create and distribute as much money as needed, and control for inflation by giving the Fed new tools. Following this logic, Money from Nothing explains how the federal government can easily fund ambitious social programs like the Green New Deal, plus implement universal basic income programs that would regularly pad the bank accounts of every American.

“This only seems far-fetched if you’re mystified about what money really is, which many of us are,” explains James. “Our book scrutinizes this source of mystery, explains how the monetary system actually works, and challenges assumptions about what we can and can’t do with money. Once you understand the system on a financial and a philosophical level, all kinds of possibilities reveal themselves to be practical.”

In addition to James’ specialty, philosophy, the book has a solid basis in economics and public policy. Co-writer Robert Hockett helped draft Rep. Alexandria Ocasio-Cortez’s Green New Deal and has worked at the International Monetary Fund and the Federal Reserve Bank of New York. The unique blend of Hockett’s economic expertise and James’ philosophical acumen gives Money from Nothing an original, interdisciplinary approach: Hockett explains the precise financial details, while James assuages people’s “philosophical hang-ups and anxieties” about what it would mean to infuse the economy with more money.

Changing “outdated cultural superstitions” about the limitations of money begins with making philosophical ideas accessible to the general public, James believes. Like Money from Nothing, some of James’s previous books — Assholes: A Theory (Doubleday, 2012) and Surfing with Sartre: An Aquatic Inquiry Into a Life of Meaning (Doubleday, 2017) — have also aimed to transform cultural assumptions beyond an academic readership.

“I think philosophers sometimes struggle to reach a broad audience, but writing about topics like money — or assholes, or a meaningful life — is a good way to do it, because you can go directly from those topics that everybody cares about to deeper issues about morality, entitlement, equality and social cooperation,” says James.

Now, in the wake of COVID-19, our cultural values, philosophical assumptions and conceptions of what’s possible are especially malleable, James insists. He and Hockett began drafting Money from Nothing in early 2019, long before the pandemic swept the world. But while readying the book for publication, they saw some of their arguments validated in real time as drastic financial measures were taken to soften the virus’s economic blow — most notably, in new Federal Reserve policies and in the CARES Act provision giving eligible Americans up to $1,200 each in direct payments.

“When we were writing the book, we worried that people would think it sounded too utopian. Now, our book is explaining what’s actually currently happening, and showing how we can continue doing it beyond this crisis — and do it well, and sustain it,” James says. “Now that we have seen that the Fed really is capable of making direct payments, creating ‘money from nothing,’ people now have a sense of possibility. We understand that it’s time to rethink our ideas of what is possible, and what would really be best for our society and our economy.”

The key to change, James argues, lies not only in economic, political or technical arguments, but in philosophy. Transforming our deeply ingrained attitudes toward money and understanding what it represents could enable the financial system to work better for all of us.

“Philosophy is necessary to help correct our faulty ideas about what money is and what its limits are,” James says. “One thing that’s encouraging, partly because of the COVID-19 crisis, is that things people thought were politically impossible are suddenly actual. People are more open to considering doing things differently, to reconceiving what’s technically and politically possible.”

James, who teaches graduate and undergraduate courses at UCI on the philosophy of money, explains that in his discipline, money and public finance are woefully under-studied — but that’s beginning to change.

“The philosophical study of money is academically demanding, cuts across a bunch of disciplines, and is very theoretical — but it also directly connects with all of our lives,” James says. “Once we tease out what money is, how it works, and what it has the potential to be, we can realize that we’ve always had the power to change the system and enhance our quality of life — to easily make possible what seems inconceivable.”

Officially out September 15, 2020, Money from Nothing is available for pre-purchase now.

Follow James on Twitter @OnAssholes.

What if money could appear in our bank accounts out of thin air — without increased taxes, longer work hours, austerity measures or any other strings attached? Not only is this utopian premise entirely possible, it might be the norm in the very near future, argues UCI philosophy professor Aaron James in his new book, Money from Nothing: Or, Why We Should Stop Worrying About Debt and Learn to Love the Federal Reserve (Melville House, 2020).

Written for the public, Money from Nothing complements an increasingly popular school of economic thought called modern monetary theory (MMT) but goes further in explaining how we can democratize the banking system and restore the social contract. James and his co-author, financial law expert Robert Hockett (Cornell University), contend that the U.S. Federal Reserve Bank is fully capable of creating money “out of thin air,” and indeed, already does to support many sectors of the economy. Since money can be created “from nothing,” the government doesn’t need tax revenue to pay for expenditures; it can simply create and distribute as much money as needed, and control for inflation by giving the Fed new tools. Following this logic, Money from Nothing explains how the federal government can easily fund ambitious social programs like the Green New Deal, plus implement universal basic income programs that would regularly pad the bank accounts of every American.

“This only seems far-fetched if you’re mystified about what money really is, which many of us are,” explains James. “Our book scrutinizes this source of mystery, explains how the monetary system actually works, and challenges assumptions about what we can and can’t do with money. Once you understand the system on a financial and a philosophical level, all kinds of possibilities reveal themselves to be practical.”

In addition to James’ specialty, philosophy, the book has a solid basis in economics and public policy. Co-writer Robert Hockett helped draft Rep. Alexandria Ocasio-Cortez’s Green New Deal and has worked at the International Monetary Fund and the Federal Reserve Bank of New York. The unique blend of Hockett’s economic expertise and James’ philosophical acumen gives Money from Nothing an original, interdisciplinary approach: Hockett explains the precise financial details, while James assuages people’s “philosophical hang-ups and anxieties” about what it would mean to infuse the economy with more money.

Changing “outdated cultural superstitions” about the limitations of money begins with making philosophical ideas accessible to the general public, James believes. Like Money from Nothing, some of James’s previous books — Assholes: A Theory (Doubleday, 2012) and Surfing with Sartre: An Aquatic Inquiry Into a Life of Meaning (Doubleday, 2017) — have also aimed to transform cultural assumptions beyond an academic readership.

“I think philosophers sometimes struggle to reach a broad audience, but writing about topics like money — or assholes, or a meaningful life — is a good way to do it, because you can go directly from those topics that everybody cares about to deeper issues about morality, entitlement, equality and social cooperation,” says James.

Now, in the wake of COVID-19, our cultural values, philosophical assumptions and conceptions of what’s possible are especially malleable, James insists. He and Hockett began drafting Money from Nothing in early 2019, long before the pandemic swept the world. But while readying the book for publication, they saw some of their arguments validated in real time as drastic financial measures were taken to soften the virus’s economic blow — most notably, in new Federal Reserve policies and in the CARES Act provision giving eligible Americans up to $1,200 each in direct payments.

“When we were writing the book, we worried that people would think it sounded too utopian. Now, our book is explaining what’s actually currently happening, and showing how we can continue doing it beyond this crisis — and do it well, and sustain it,” James says. “Now that we have seen that the Fed really is capable of making direct payments, creating ‘money from nothing,’ people now have a sense of possibility. We understand that it’s time to rethink our ideas of what is possible, and what would really be best for our society and our economy.”

The key to change, James argues, lies not only in economic, political or technical arguments, but in philosophy. Transforming our deeply ingrained attitudes toward money and understanding what it represents could enable the financial system to work better for all of us.

“Philosophy is necessary to help correct our faulty ideas about what money is and what its limits are,” James says. “One thing that’s encouraging, partly because of the COVID-19 crisis, is that things people thought were politically impossible are suddenly actual. People are more open to considering doing things differently, to reconceiving what’s technically and politically possible.”

James, who teaches graduate and undergraduate courses at UCI on the philosophy of money, explains that in his discipline, money and public finance are woefully under-studied — but that’s beginning to change.

“The philosophical study of money is academically demanding, cuts across a bunch of disciplines, and is very theoretical — but it also directly connects with all of our lives,” James says. “Once we tease out what money is, how it works, and what it has the potential to be, we can realize that we’ve always had the power to change the system and enhance our quality of life — to easily make possible what seems inconceivable.”

Officially out September 15, 2020, Money from Nothing is available for pre-purchase now.

Follow James on Twitter @OnAssholes.

Philosophy